Hey Scam Warriors, In the past year, Apple Pay text scams have been on the rise, targeting users with fake alerts and phishing messages. With 155 million iPhone users in the USA, this scam targets a large number of American citizens. Also, such a large number of iPhone users helps in making this scam more dangerous and damaging than other scams. As people are spending more time on phones than on computers, the scammers are now shifting focus from computer-based tech scams to phone-based tech scams. These scams are designed to trick you into revealing your Apple ID, payment details, and sometimes even your banking information.

If you use Apple Pay—or even if you don’t—knowing how this scam works can protect your money and your identity.

What Is the Apple Pay Text Scam?

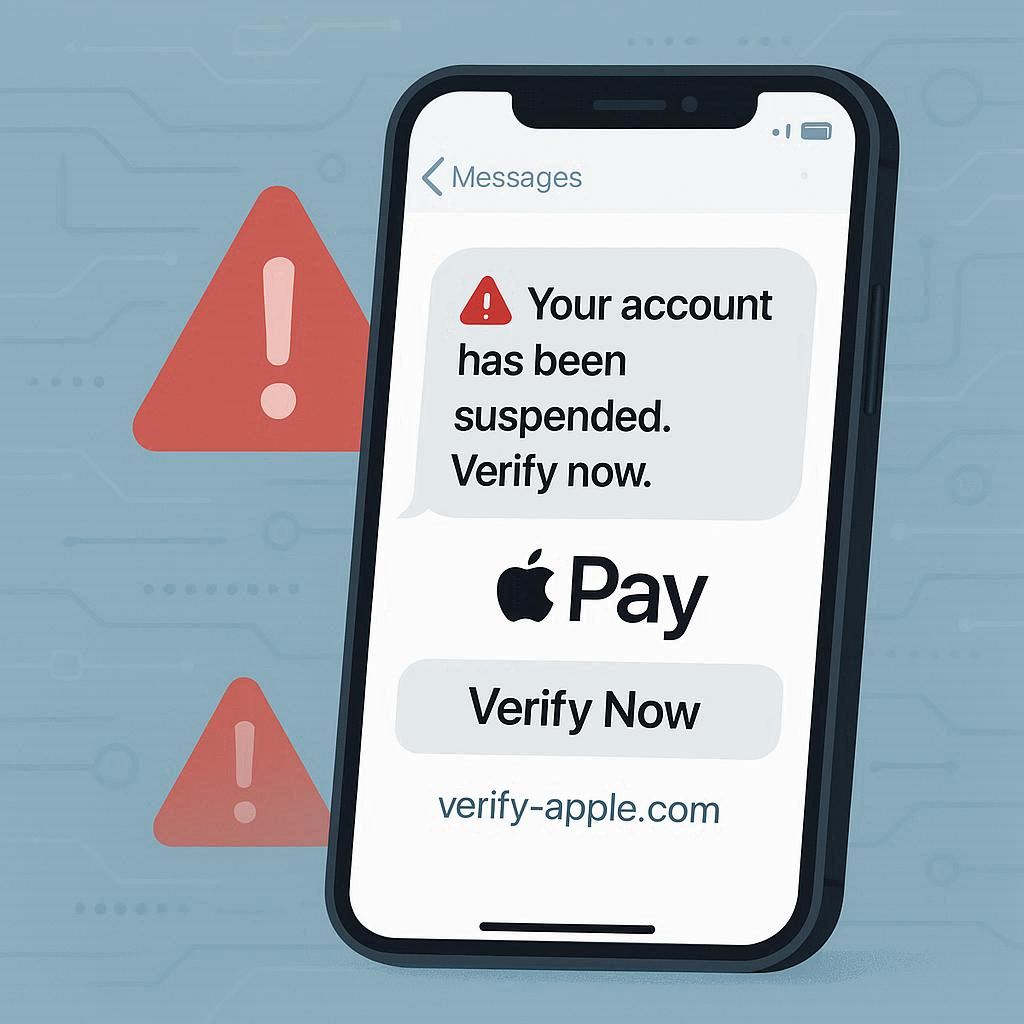

The Apple Pay text scam is a type of phishing scheme where scammers impersonate the tech giant Apple or your bank. After impersonating these reputable organizations, they try to win your trust and send you a text message with a warning that your Apple Pay account has been locked, suspended, or flagged for unusual activity.

This text message is a fake Apple Pay alert that includes a link to a convincing but fraudulent website designed to look like Apple’s official page. When people visit this site, they feel they are on the official Apple website because the look and feel of the website match the original one. Once on the site, people are prompted to enter their login information, which is then misused by the scammers to blackmail victims or to extort money from them.

How the Scam Works

Scammers have a playbook for this fraud, and it typically looks like this:

Step 1: The Fake Apple Pay Alert

victims get a text that appears to come from “Apple” or their bank. This is SMS spoofing, which makes the sender’s name look real. The main purpose of this step is to impersonate a legitimate organization to win the victim’s trust, which makes the coming steps easier.

Example:

You get a text message from an unknown number saying:

WARNING! Your Apple account has been suspended due to unusual activity. To secure your account urgently, verify your identity using the given link: [malicious link]

Or

An Apple Pay transaction of $157.95 was detected at the Apple Store. Call Apple Support now [+1-fraudulent number] if this is unauthorized.

Step 2: The Phishing Link / Fake Apple Support Number

The link leads to a fake Apple Pay sign-in page. The site might look perfect—logo, colors, and layout all match Apple’s official site. The design is kept the same to trick users into believing that they are on the official site, so that they feel confident and secure while entering their personal details.

OR

You get a fake Apple support number, which will connect you to a scammer, most probably sitting in a foreign country, who will then try to gain your information and try to take gift card payments from you.

Step 3: Credential Theft

You’re prompted to enter your Apple ID, password, and sometimes credit card information. Once submitted, scammers instantly capture this data. Their final goal is not identity theft, but to use this data to make victims pay using gift cards, or even worse. Once they have your data, they can impersonate other government agencies and frame you in fraudulent cases and compel you to transfer all your funds into scammers’ bank accounts or crypto wallets.

Step 4. Account Takeover

With your Apple ID, scammers can:

- Add their devices to your Apple Pay account.

- Make fraudulent purchases.

- Lock you out by changing your password.

- Access other accounts if you reuse passwords.

- Use your information to frame you into fraudulent cases and drain your bank accounts.

Why People Fall for the Apple Pay Phishing Message

The answer is simple, but the technique is very effective. The scammers use the impersonation method and social engineering to make people believe that they are dealing with a legitimate organization.

Once they establish the first step, they use words like “account suspension” or “unauthorized activity,” which creates a sense of urgency that overrides logical thinking. This fear of losing access to the account forces victims to act immediately. In this urgency, the victims do not verify the malicious links and click the links without verifying their authenticity.

This technique of creating trust and urgency is very effective, which makes the majority of people fall for this trap.

Signs of an Apple Pay Text Scam

Here’s how to recognize the Apple Pay Text Scam:

- Suspicious URLs – If it doesn’t end with apple.com, it’s not real. Let me be frank, it is not easy to recognize fake URLs. A lot of thought and social engineering is used in creating these to make them look real. The golden rule here is not to click any URL sent to you out of the blue. Just go to your web browser and visit the official Apple website to gain verified information.

- Generic greetings – “Dear customer” instead of your name. If the message starts with “Dear customer” instead of your name, then there are high chances that the message is fake and is designed to target a bulk audience to scam them.

- Urgent threats – “Immediate action required” or “final warning.” Always remember, no legitimate company will put you under pressure to act immediately. These kinds of messages are given so that you act without thinking rationally.

- Poor grammar or spelling – Official companies rarely make grammatical mistakes. A message containing a grammar or spelling mistake is a red flag.

- Requests for sensitive data – Apple will never ask for your password or payment info via text. Legitimate companies have a professional way of working and defined SOPs for every procedure.

How to Protect Yourself from Apple Pay Scams

- Never Click Suspicious Links: Suspicious links are designed to look trustworthy and authentic using social engineering methods. With social engineering, urgency is created to make you click on suspicious links without verifying them.The golden rule here is to not click on any links sent to you with urgency messages and go to trusted sources like appleid.apple.com or open the Apple Wallet app directly

- Turn On Two-Factor Authentication (2FA): Two-factor authentication makes it difficult for scammers to obtain your information by creating an additional layer of security for your account, which is difficult to breach. This makes it harder for scammers to log in even if they have your password.

- Block and Report the Sender: Once you know that the text message is fraudulent, don’t just ignore it. Forward scam texts to 7726 (SPAM) and email them to reportphishing@apple.com so that the right actions can be taken against the sender and more people can be protected.

- Use Strong, Unique Passwords: Don’t reuse passwords, especially for your Apple ID and banking accounts. Many people have a habit of using the same password on multiple accounts, which is a terrible practice. If you lose the password of one account, the other accounts get automatically exposed. Also, don’t use easy passwords like your date of birth, spouse’s name, etc., which are easy to crack. Instead, use at least an 8-10-character-long password containing letters (both caps and small), numbers, and special characters.

Example: Susan2101 is a weak password, but A#45c58dF? is a strong password.

- Review Linked Devices: Regularly check which devices have access to your Apple ID and remove any you don’t recognize. By doing this, you can easily recognize how many devices your Apple ID is logged in on. If it is logged in on any device that you don’t recognize, then you should log out of unknown devices and change your passwords immediately.

What to Do If You Fall for an Apple Pay Scam

If you entered your details on a fake verification link:

- Change your Apple ID password immediately. A changed password will protect your accounts, and you can outsmart the scammer by doing this.

- Turn on two-factor authentication. As I said before in this post, two-factor authentication enhances your account security, which makes it difficult for a scammer to gain access to your account.

- Contact your bank to block or monitor your cards. If you get trapped in any of such kinds of scams, then immediately contact your bank to block your cards to prevent any financial damage.

- Report the scam to Apple and your local cybercrime unit. The easiest way to report this kind of fraud is by forwarding scam texts to 7726 (SPAM) and emailing them to reportphishing@apple.com

The Bottom Line:

The Apple Pay text scam is convincing and dangerous, but knowledge is your best defense. If a message asks you to verify or unlock your account, treat it as suspicious until proven otherwise.

Golden rule: Always go directly to the official Apple site or app. Never trust links in unsolicited texts.

By spotting the red flags and following these Apple Pay fraud prevention steps, you can keep your account—and your money—safe.

One more thing that always helps you prevent scams is our website. Make sure to follow us on Instagram and sign up for our Newsletter to always stay ahead of scammers.